Derivatives Call And Put Options. When an option is exercised the cost to the buyer of the asset acquired is the strike price plus the premium if any. Das bedeutet dass die Preisentwicklung eines Derivats z. Call and put options which give their. Introduction To OPTIONSBy.

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

Have a look at complete derivatives market in india with futures and option most active calls most active puts option gainers and losers arbitrage opportunities etc. A long straddle options strategy occurs when an investor simultaneously purchases a call and put option on the same underlying asset with the same strike price and expiration date. Aktien Zinsen Währungen abgeleitet sind lateinisch. Derivate Futures Optionen Swaps. A call option would normally be exercised only when the strike price is below the market value of the underlying asset while a put option would normally be exercised only when the strike price is above the market value. A call option gives the holder the.

When an option is exercised the cost to the buyer of the asset acquired is the strike price plus the premium if any.

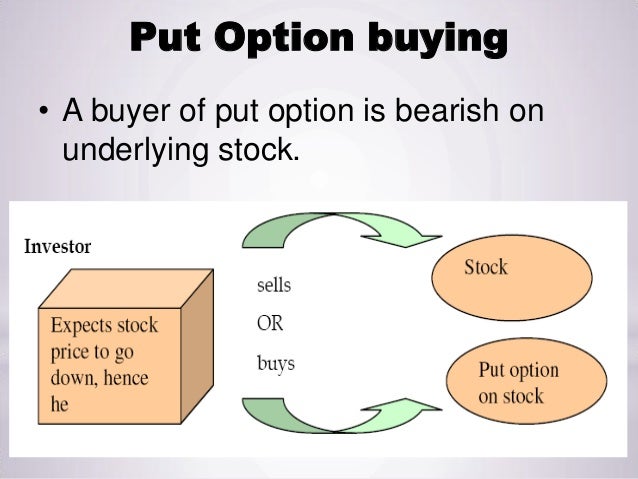

The call option generates money when the value of the underlying asset is rising upwards whereas the put option will extract money when the value of the underlying is falling. When an option is exercised the cost to the buyer of the asset acquired is the strike price plus the premium if any. Aktien Zinsen Währungen abgeleitet sind lateinisch. Call and put options which give their. Options An option is a derivative financial instrument that specifies a contract between two parties for a future. What is Call and Put Option.