Industry Risk Premium 2015. I made a judgment that the equity risk premium 578 which I approximate to 575 that I obtained for the SP 500 was a good measure of the mature market risk premium and adding the country risk premium yields the total equity risk premium for each country. Market risk premium MRP in Belgium compared to Europe 2014-2020 Average market risk premium in Italy 2011-2018 Reinsurance ceded. If the ERPi sometimes called RPm risk premium for the market is 7 percent and the industry betas are as below the IRP would be. Industry Risk Premia Company List December 31 2015.

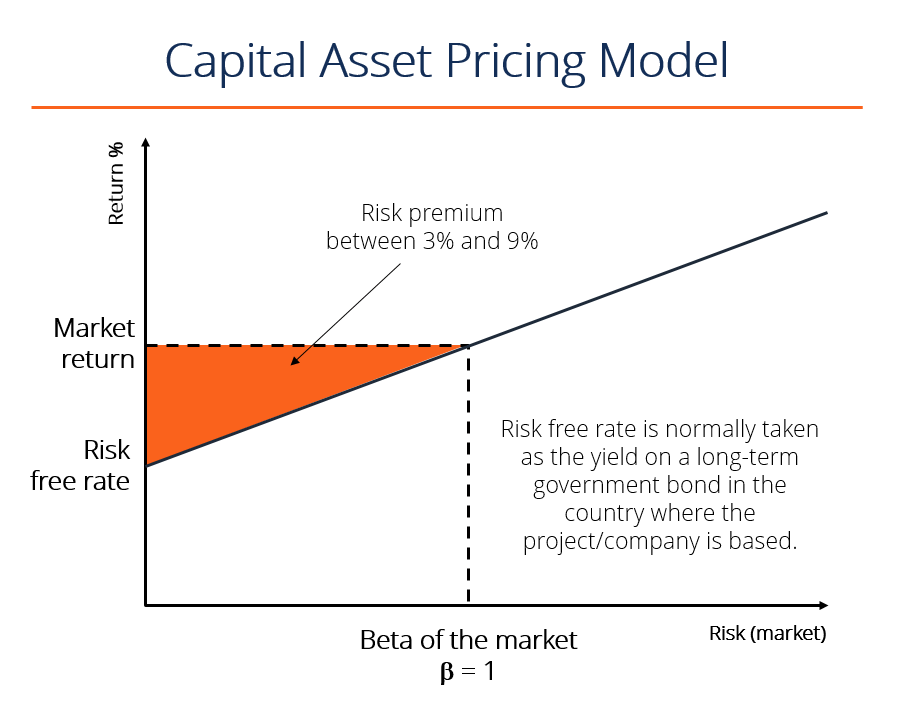

On the other hand a firm could have a specific company risk premium of. Most of the respondents use for US Europe and UK a Risk-Free Rate RF higher than the yield of the 10-year Government bonds. I Risk index for industry i ER P Expected equity risk premium2 The risk index for the industry consists of a beta calculation. Interestingly the increased premium and risk are not reflected in market-based measures of risk such as the VIX and credit spreads. Market risk premium is the difference between the expected return on a market portfolio and the risk-free rate. Partington Report to Corrs Chambers Westgarth.

The change between 2013 and 2015 of the average Market risk premium used was higher than 1 for 13 countries see figure 4.

The change between 2013 and 2015 of the average Market risk premium used was higher than 1 for 13 countries see figure 4. It is an important element of modern portfolio theory and discounted cash flow. Empirical estimates of risk premium from securities markets. Lally M Review of submissions to the QCA on the MRP risk-free rate and gamma 12 March 2014. Higher-Risk Scenario Lower-Risk Scenario IRP i 13 7 7 IRP i 06 7 7 IRP i. To complete the picture I used the PRS scores for those frontier markets such as.