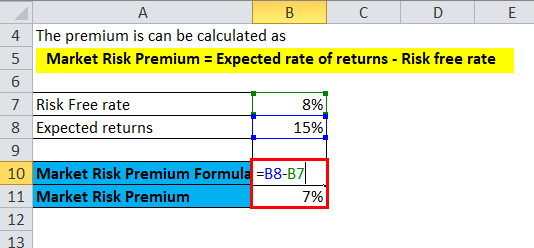

Pure Risk Premium Calculation. The risk for a premium that is less than 8719 C will be able to invest the remaining assets net of premium and obtain a better return than by retaining the risk. This premium is a decreasing function of a when a 0 the premium. Risk Premium and is denoted by RP symbol. The risk premium is calculated by subtracting the return on risk-free investment from the return on investment.

A pure premium rate is an estimate of the amount an insurance company needs to collect to offset any potential claim on your policy. In general the greater the risk the higher the return that should be demanded. The premium calculation principle is one of the main objectives of study for actuaries. The pure risk premium in the case of the fixed amount deductible of b is given by PFADb P EX b PFDb b1 Fb. Risk Premium formula helps to get a rough estimate of expected returns on a relatively risky investment as compared to that earned on a risk-free investment. During 1990-1992 soft rates together with a blight of recession related claims and the 1990 storms led to large losses.

Premium Rate x Exposures If Premium is measured in units such as dollars Exposures in units such as Car.

Formula s to Calculate Risk Premium RISK PREMIUM PERCENT RETURN FROM AN INVESTMENT - PERCENT RETURN ON A RISK FREE INVESTMENT. Risk Premium Formula Ra Rf r a asset or investment return. Apart from this period the insurance returns have been good. If C cedes the risk for a premium of 610 the long-term effective rate of return will be. To use this online calculator for Risk Premium enter Return on Investment ROI ROI and Risk Free Return Rf and hit the calculate button. R f is the risk-free rate of return and R m -R f is the excess return of the market multiplied by the stock markets beta coefficient.